2025 Ira Contribution Limits Chart Roth. The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're younger than age 50. You can make 2025 ira contributions until the.

The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you’re age 50 or older. retirement savers age 50 and older can chip in an.

2025 Ira Contributions Chart Sybyl Eustacia, This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

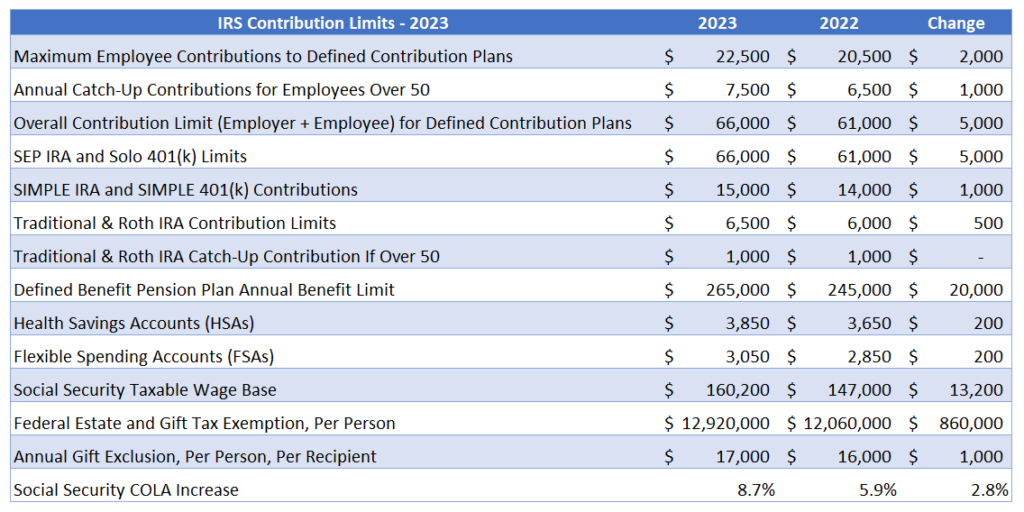

2025 Contribution Limits Announced by the IRS, Not fdic insured • not insured by any federal government agency • not a deposit or.

T2024 Contribution Limits Roth Ira Sabra Clerissa, In 2025, the roth ira contribution limit is $7,000,.

Annual Roth Ira Contribution Limit 2025 Effie Halette, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Annual Roth Ira Contribution Limit 2025 Effie Halette, You can make 2025 ira contributions until the.

Roth Ira Limits 2025 Vanguard Roth Reina Charleen, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

2025 Ira Limits Irs Ceil Meagan, The maximum total annual contribution for all your iras combined is:

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

IRA Contribution Limits in 2025 Meld Financial, If you are 50 or older by the end of 2025, you may contribute up to $8,000 to a roth ira.