Short Term Capital Gains Tax Rate 2025 Irs. » ready to crunch the numbers? That’s up from $44,625 this year.

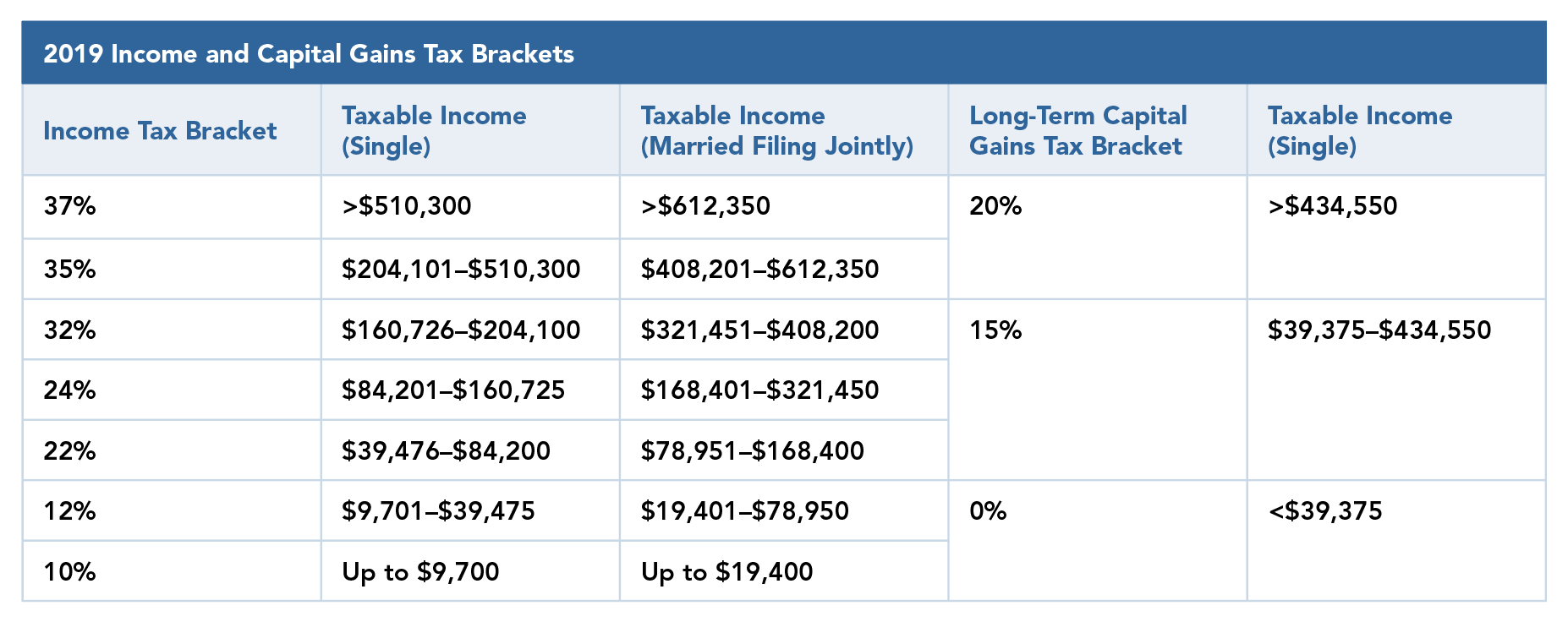

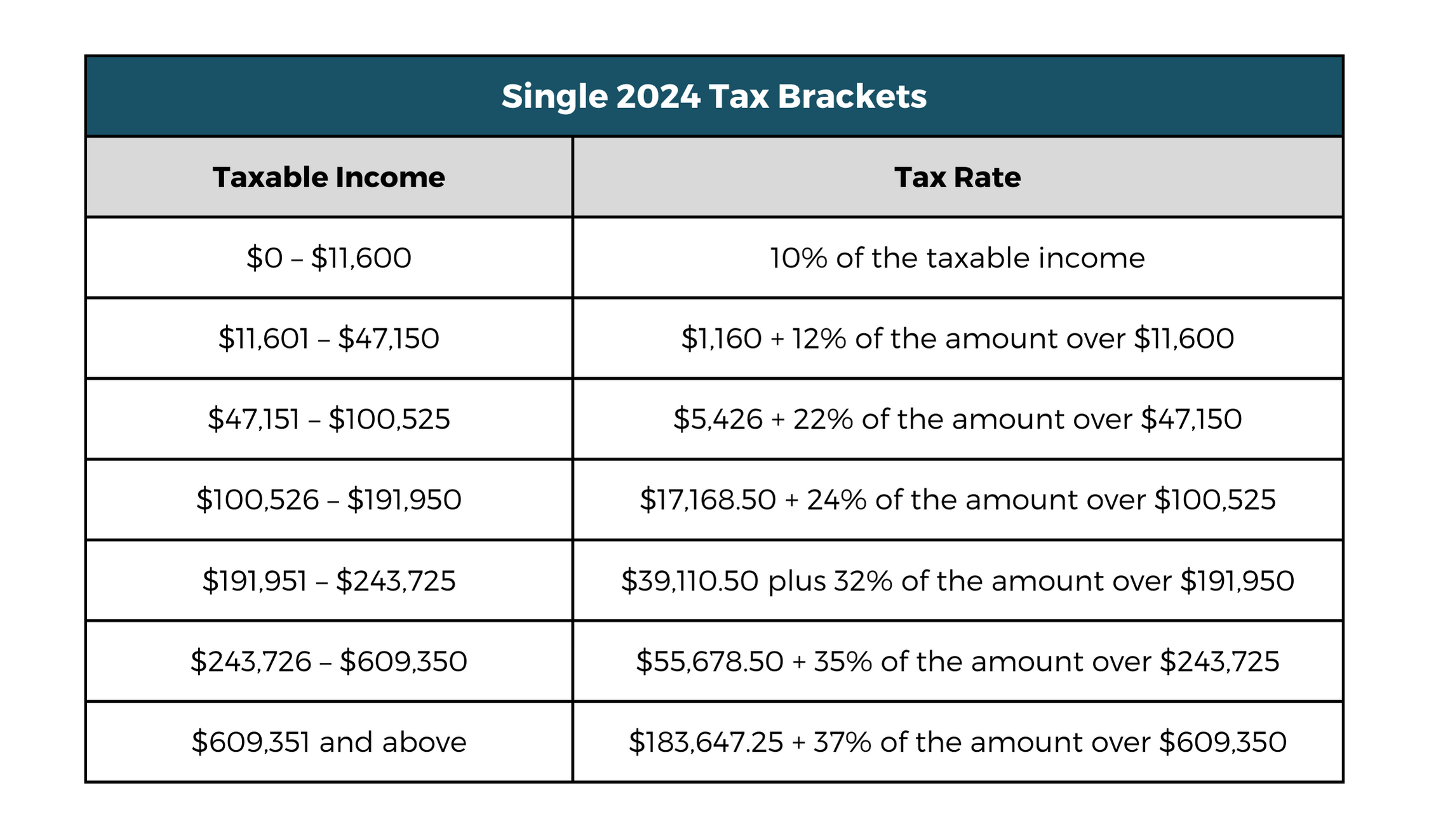

Capital Gains Tax Rate 2025 Dredi Ginelle, 10%, 12%, 22%, 24%, 32%, 35% or 37%. What is the capital gains tax and when is it applicable?

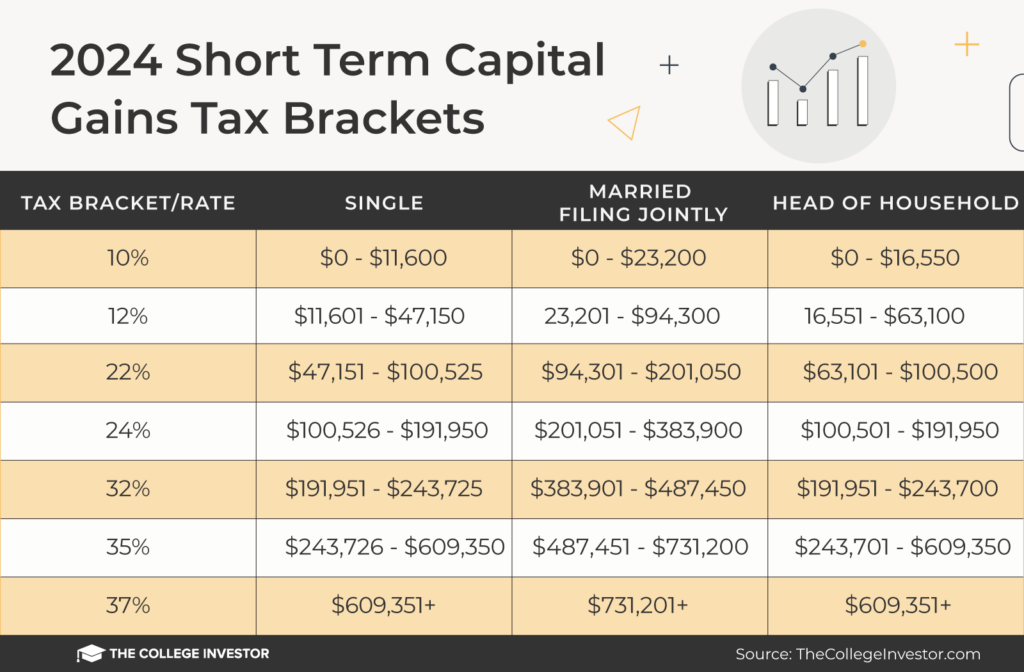

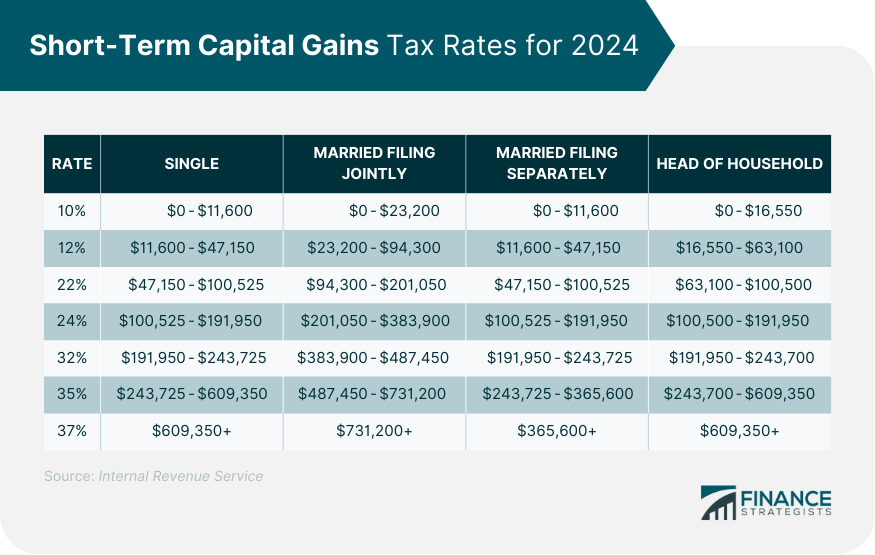

Capital Gains Tax Brackets And Tax Rates, The table below breaks down the. It's also important to note.

Short Term Capital Gains Tax Rate 2025 Allix, The table below breaks down the. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

California Capital Gains Tax Rate 2025 Real Estate Carley Margaux, High income earners may be subject to an additional. The 2025 tax brackets are 10 percent, 12 percent, 22.

ShortTerm And LongTerm Capital Gains Tax Rates By, Ordinary income tax rates, up to 37%. High income earners may be subject to an additional.

Capital Gains Tax Rate 2025 Overview and Calculation, High income earners may be subject to an additional. 10%, 12%, 22%, 24%, 32%, 35% or 37%.

ShortTerm Capital Gains Tax Rate 20232024 Overview, Ordinary income tax rates, up to 37%. 10%, 12%, 22%, 24%, 32%, 35% or 37%.

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, 10%, 12%, 22%, 24%, 32%, 35% or 37%. What is the capital gains tax and when is it applicable?

2025 Tax Code Changes Everything You Need To Know RGWM Insights, What is the capital gains tax and when is it applicable? That’s up from $44,625 this year.

ShortTerm And LongTerm Capital Gains Tax Rates By, In 2025, individuals’ taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate. The table below breaks down the.

In 2025, individuals’ taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate.